This version of TaxCycle addresses recently reported customer concerns.

We will not enable the automatic update for this version until after the T1 filing deadline on April 30, 2024.

To install this version immediately, download the full setup program from our website. Or, you may deploy auto-update files from your network, available from the Auto-Update Files page.

Once we enable the automatic update for this version after the filing deadline, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options.

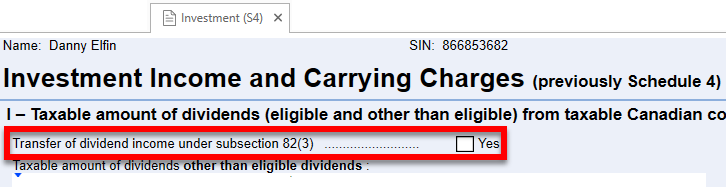

Customer Request We have added a check box to the Investment Income and Carrying Charges worksheet for the Transfer of dividend income under subsection 82(3) where the transfer will result in the higher income spouse being able to claim a higher spousal amount.

By checking this box, you can transfer dividend income from a lower income spouse to the higher income spouse with just one click.

When the condition that the transfer would increase the spousal amount is met, and you check the box to initiate the transfer, the amounts will appear on the higher income spouse’s worksheet with the offset appearing on the lower income spouse’s worksheet.

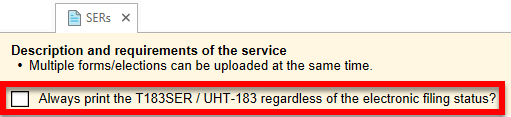

Note: The printing update on the SERs worksheet above also applies to the T183SER in TaxCycle T2.